Investing Opportunities

Different Strategies to Align your Goals and Financial Status

Active Investing: DIY

If You're a Stage 1 Investor Just Getting Started...

Real estate is one of the most reliable ways to build long-term wealth, but getting started can feel intimidating. The good news is there are several beginner-friendly strategies that let you break in without needing huge amounts of cash. Two of the most popular approaches are House Hacking and the BRRRR method.

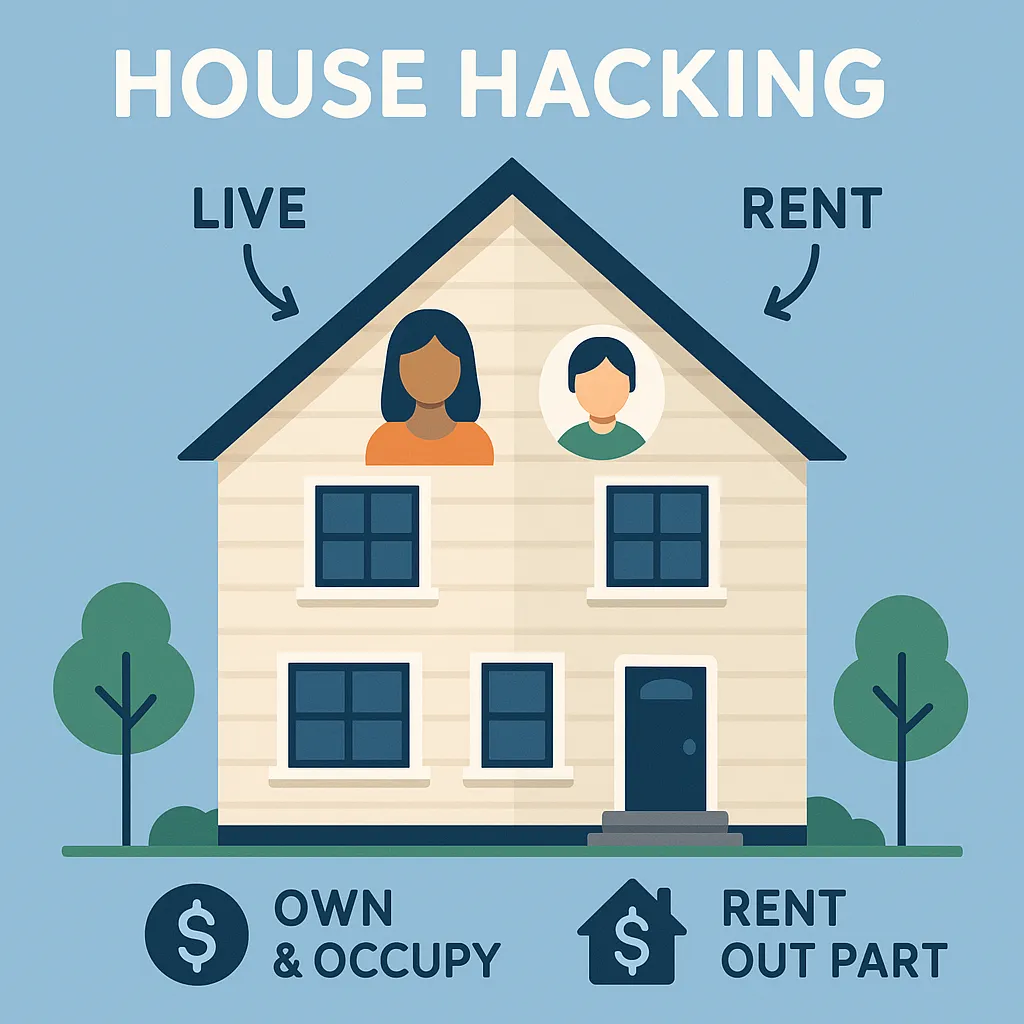

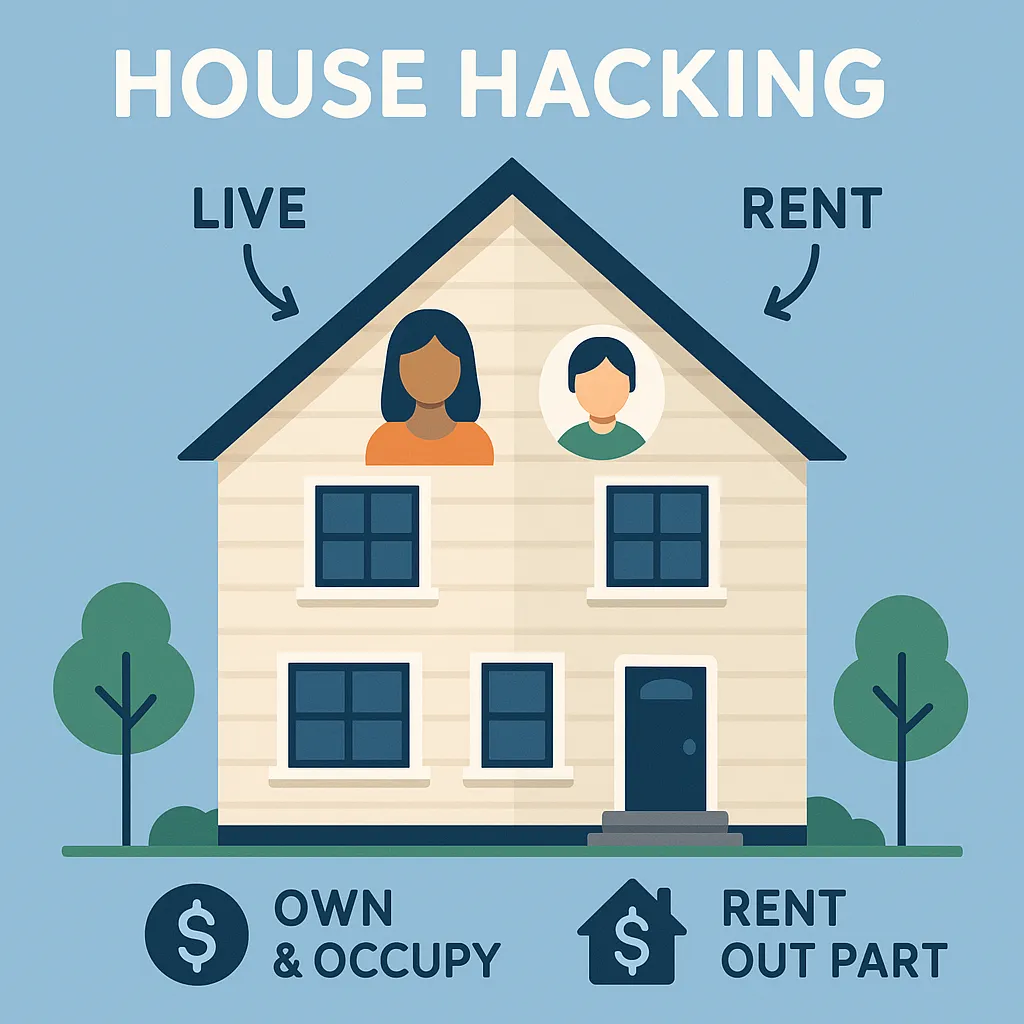

House Hacking

House Hacking

House hacking is often the simplest entry point. It involves:

Buying a property, living in part of it, and renting out the rest to offset your housing costs

Purchase a duplex, triplex, or fourplex, live in one unit, and rent out the others

Or you could buy a single-family home and rent out extra bedrooms to roommates

The rental income helps cover your mortgage, letting you live cheaply (or even for free) while building equity and learning the basics of property management.

You can now take more tax write-offs!

House Hacking

House hacking is often the simplest entry point. It involves:

Buying a property, living in part of it, and renting out the rest to offset your housing costs

Purchase a duplex, triplex, or fourplex, live in one unit, and rent out the others

Or you could buy a single-family home and rent out extra bedrooms to roommates

The rental income helps cover your mortgage, letting you live cheaply (or even for free) while building equity and learning the basics of property management.

You can now take more tax write-offs!

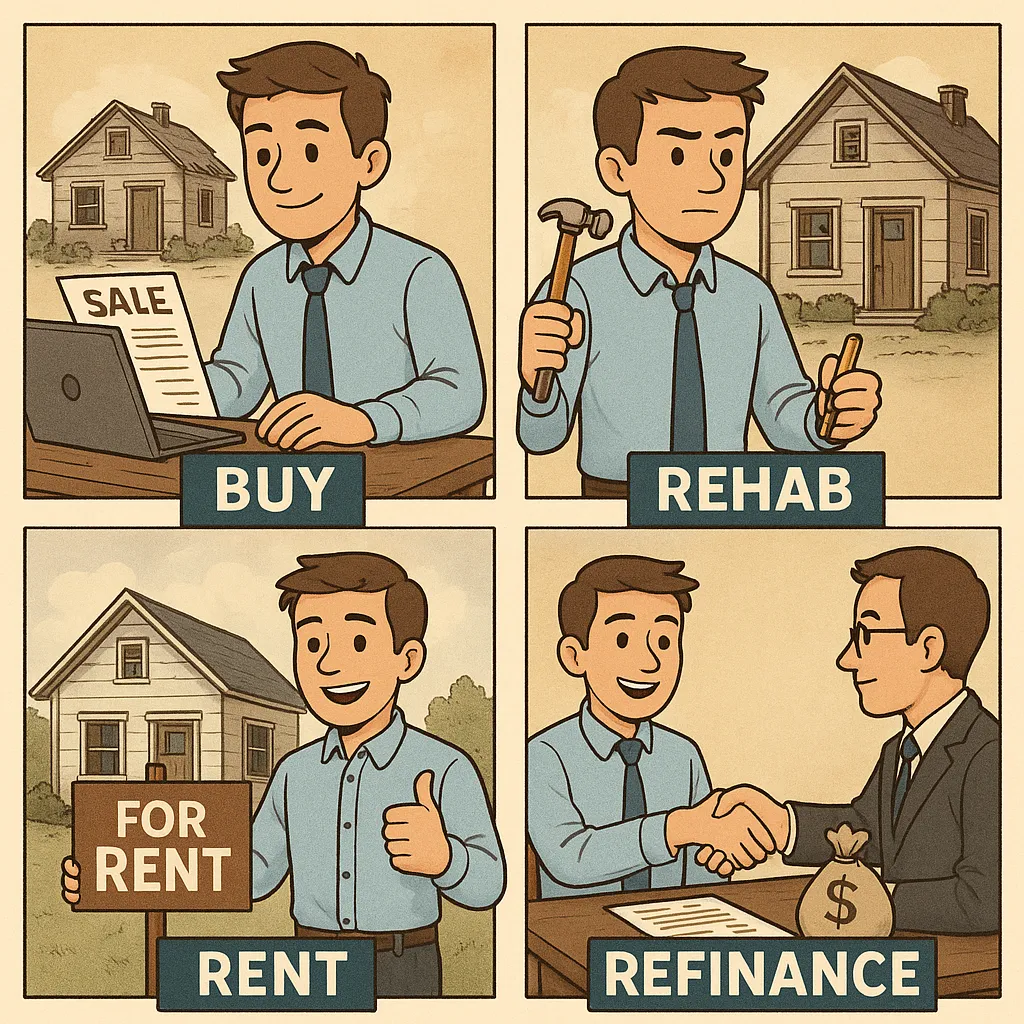

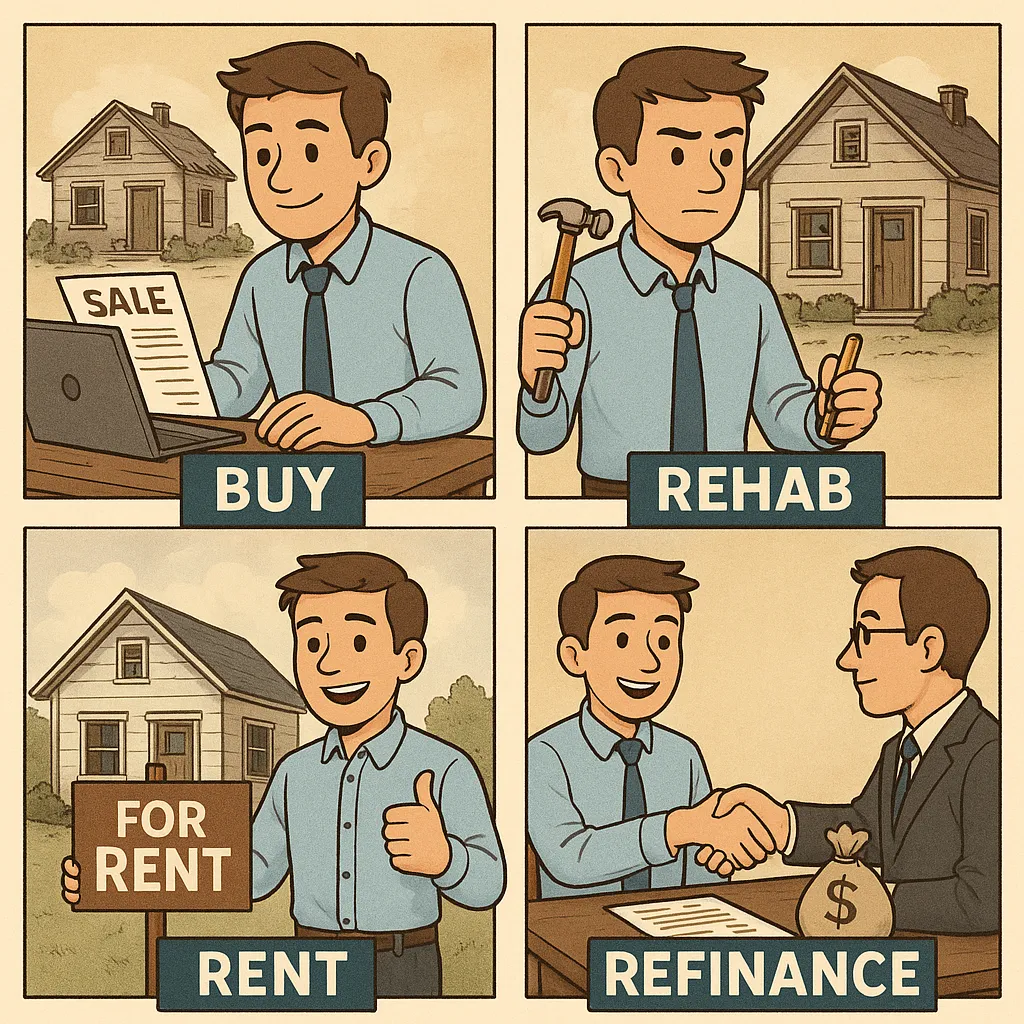

BRRRR

The BRRRR method which stands for Buy, Rehab, Rent, Refinance, Repeat is another powerful way to build a portfolio quickly.

Buy a property that needs work, renovate it to boost its value

Rent it out to create steady cash flow

Refinance to pull most (or all) of your original cash back out. This allows you to use the same money to buy your next property, effectively recycling your capital.

While it’s an excellent strategy for scaling up, it does require careful planning, solid budgeting, and a lender who will refinance based on the new value.

The BRRRR method which stands for Buy, Rehab, Rent, Refinance, Repeat is another powerful way to build a portfolio quickly.

Buy a property that needs work, renovate it to boost its value

Rent it out to create steady cash flow

Refinance to pull most (or all) of your original cash back out. This allows you to use the same money to buy your next property, effectively recycling your capital.

While it’s an excellent strategy for scaling up, it does require careful planning, solid budgeting, and a lender who will refinance based on the new value.

Passive Growth: Syndication

If You're a Growth Builder or an Accredited Investor...

If you want to invest in real estate without managing properties yourself, a syndication could be a great option.

In a syndication, many investors pool their money to buy larger assets like apartment complexes, RV parks, or storage facilities.

A sponsor (or general partner) finds the deal, arranges financing, and runs the project. As an investor, you come in as a limited partner (LP): you provide capital, share in the profits, and avoid the day-to-day work.

Returns often include a preferred return, paying investors a set annual rate before the sponsor takes a share, plus profit splits or waterfalls that reward the sponsor if the project does well.

Most syndications are regulated by the SEC and use exemptions under Regulation D:

506(b) allows up to 35 non-accredited investors plus unlimited accredited investors, but requires a pre-existing relationship and no public advertising.

506(c) lets the sponsor publicly market the deal, but only accredited investors who can verify income or net worth can invest.

Passive Growth: Preferred Equity

If You're an Accredited Investor...

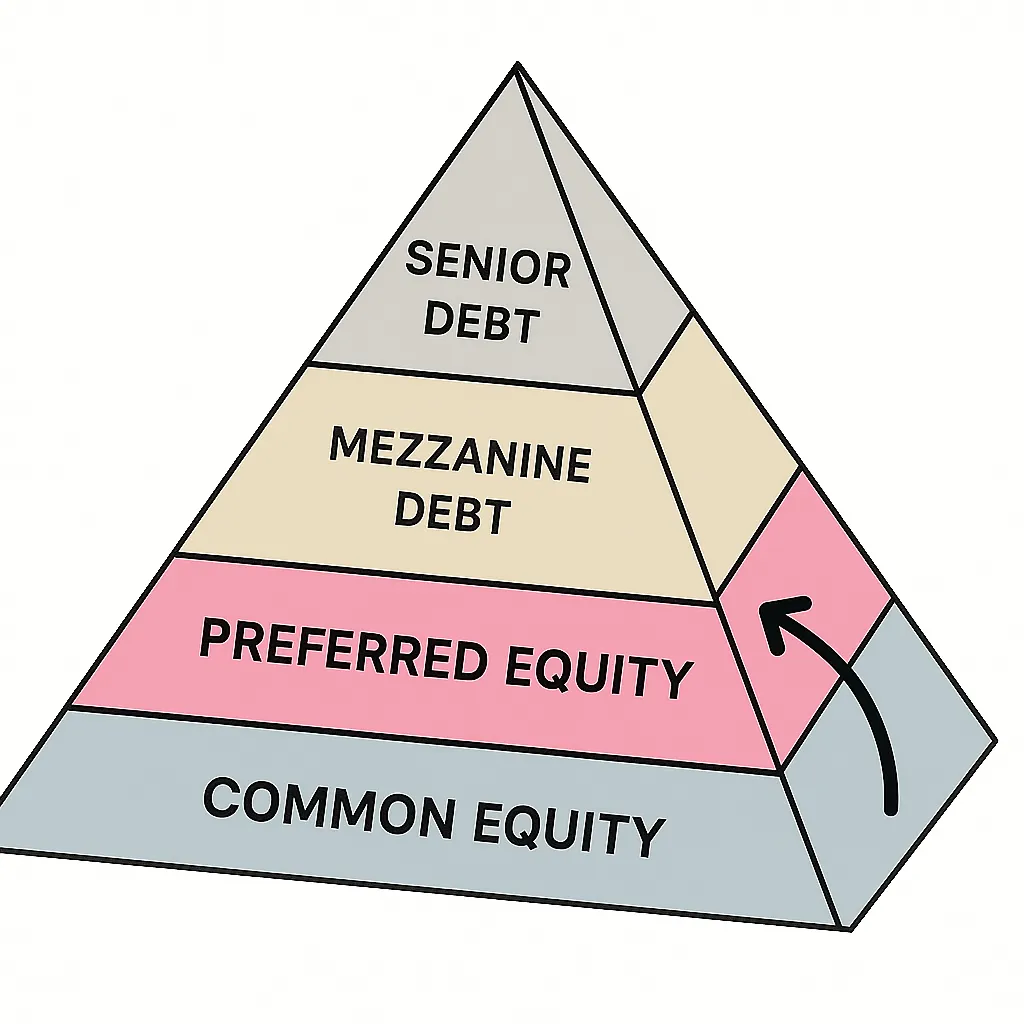

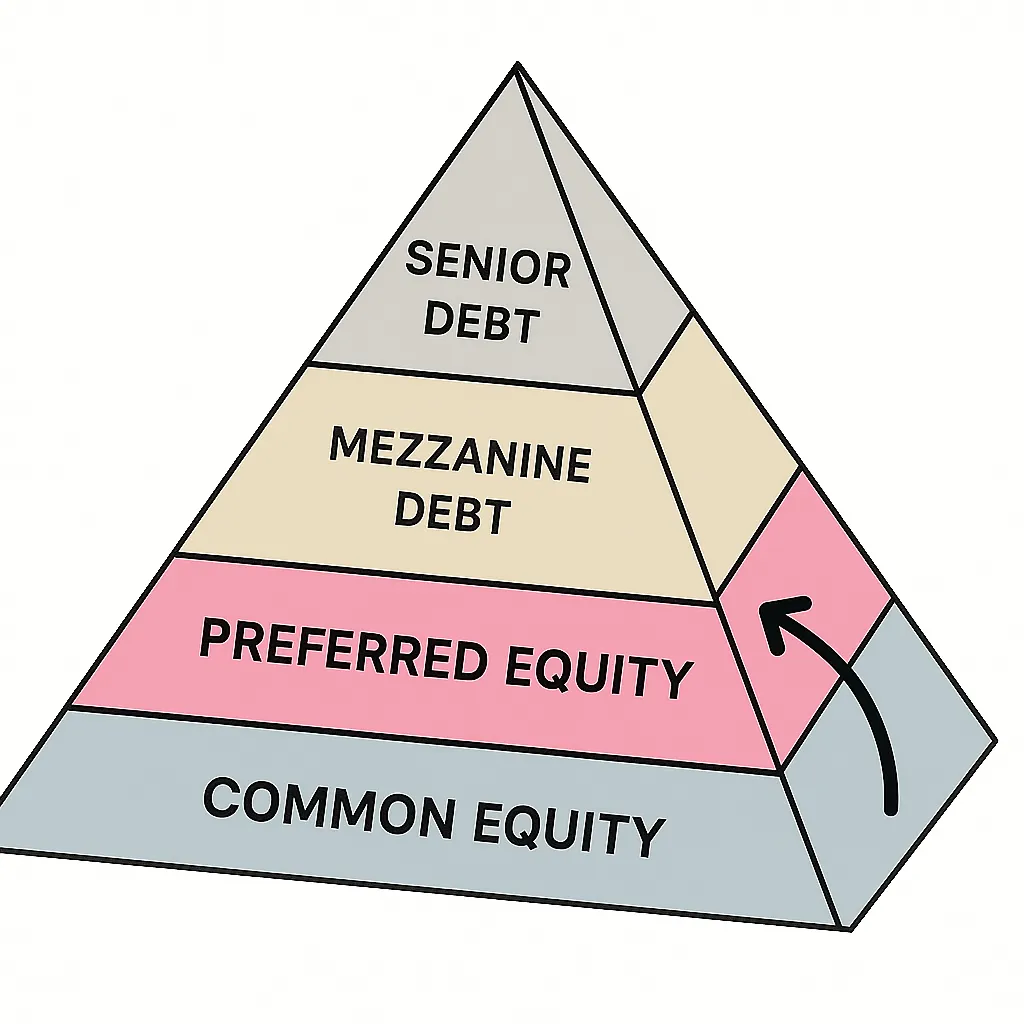

What Preferred Equity Means in a Deal:

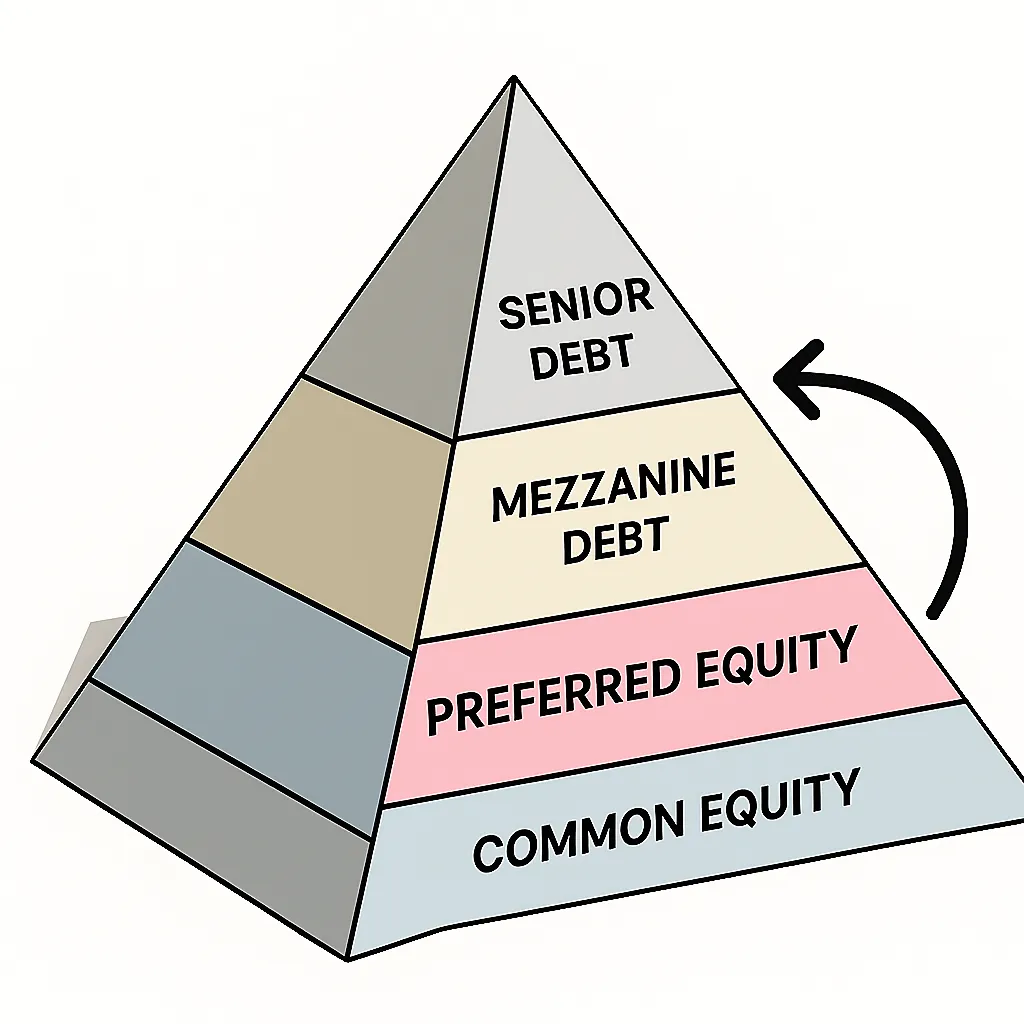

You get paid before common equity partners (like the sponsors), but after the bank loan.

Typically comes with a fixed preferred return (e.g., 8–12%).

Offers more predictable cash flow than standard equity.

No mortgage lien, but still secures your spot in the payment hierarchy.

Why Investors Like It:

Steadier returns with less risk than common equity.

Priority on repayments if the project underperforms.

Great for investors who want consistent income rather than chasing big upside.

Sometimes includes extra profit share, but not always.

Passive Growth: Be the Bank

If You're a High Net Worth Individual...

What It Means to Invest as a Lender (Debt Capital):

You’re at the top of the capital stack — repaid before equity investors.

Earn a fixed interest rate for predictable income.

Your investment is secured by the property (via a mortgage or deed of trust).

You have the right to foreclose if obligations aren’t met.

Why Investors Like It:

Highest priority for repayment = lower risk.

Ideal for those focused on capital preservation and steady cash flow.

No exposure to performance swings or market volatility.

You don’t share in upside, but you avoid most of the downside.

Why Talk About These Stages?

At NPV, we believe it’s critical for investors to understand the differences between:

active real estate investing (where you handle everything yourself)

real estate syndications (where you’re a passive partner in a larger deal)

preferred equity structures (which often pay a steady return with added protection)

private loans (where you act as the lender, earning interest with collateral backing).

Each option comes with its own risk profile, return potential, level of involvement, and time horizon. That’s why we focus on matching investors to the right type of investment, asset class, return structure, and timeframe — because not every deal is right for every investor.

If you want to build a strategy that truly fits your goals and your stage of life, schedule a meeting with us today. We’ll run the numbers and help you find opportunities that make sense for you.